As young adults choose between renting for mobility or buying for brand-building, extended-term loans offer short-term relief but challenge long-term wealth paths, according to Alan Majzner

Donald Trump’s proposal for a 50-year mortgage has quickly become a point of discussion across financial media, the real estate sector, and the digital-age creator economy driving social media.

For younger adults, navigating high-living costs, rising rents, and a competitive housing market, the appeal is: lower monthly payments, access to larger or more desirable spaces, and a simplified entry point into homeownership. Less housing hassle means more time to hustle.

Alan Majzner is a nationwide mortgage expert & loan strategist, who has served thousands of clients and the local New York City area for decades. Industry leaders like Majzner offer key insight on the sentiment following this “proposal.”

“A lot of people are happy, a lot of people are terrified,” Majzner said.

At a marketing level, the pitch is strategic. Extending a mortgage term reframes affordability by shifting the focus from total cost to monthly cash flow – something Gen Z and millennial buyers consistently prioritize. This flexibility mirrors broader trends among younger workers and digital-native professionals, who often pursue non-linear career paths and value optionality over long-term commitments.

In industries tied to digital production, where workspace doubles as content, owning a home can even be part of a personal brand. MTV Cribs, which aired from 2000-23 with 19 seasons and two revivals, is a close comparison to assessing modern popularity behind why an emerging social media talent would choose to care about real estate and promoting personal homeownership.

The financial mechanics, however, complicate the potential appeal. According to UBS estimates referenced in the real estate industry, extending a mortgage from 30 to 50 years could reduce monthly payments by roughly $120 to $700 on a median-priced home, depending on interest rates around 6.5%. Interest rates fluctuate, directly affecting purchasing habits for Americans.

For a $400,000 property, aligned with markets like Austin, Texas and similar emerging creative hubs, the annual payment difference may reach $8,400. Those savings, however, are front-loaded. Over the lifetime of the loan, interest accumulation expands dramatically, with total payments potentially doubling compared to a standard 30-year mortgage.

Mortgage professionals, like Majzner, also highlight the impact on equity building.

“With a 50-year term, all you’re paying is interest, interest, and more interest up front,” Majzner said regarding the logistics of a long-term 50-year mortgage payment.

A 50-year term significantly slows the pace at which a buyer gains ownership stake; compared to a traditional 30-year loan, early equity can be cut nearly in half, as more of each payment is directed toward interest rather than principal. This structure may benefit borrowers seeking immediate monthly relief, but it delays long-term financial stability and wealth creation.

Alternatives exist that may support affordability without extending debt for half a century. FHA loans with 3.5% down, Fannie Mae’s HomeReady program for qualifying moderate-income buyers, and emerging co-buying arrangements among the tail-end of the millennial generation and a growing number of Gen Z adults all provide different ways to enter the market sooner.

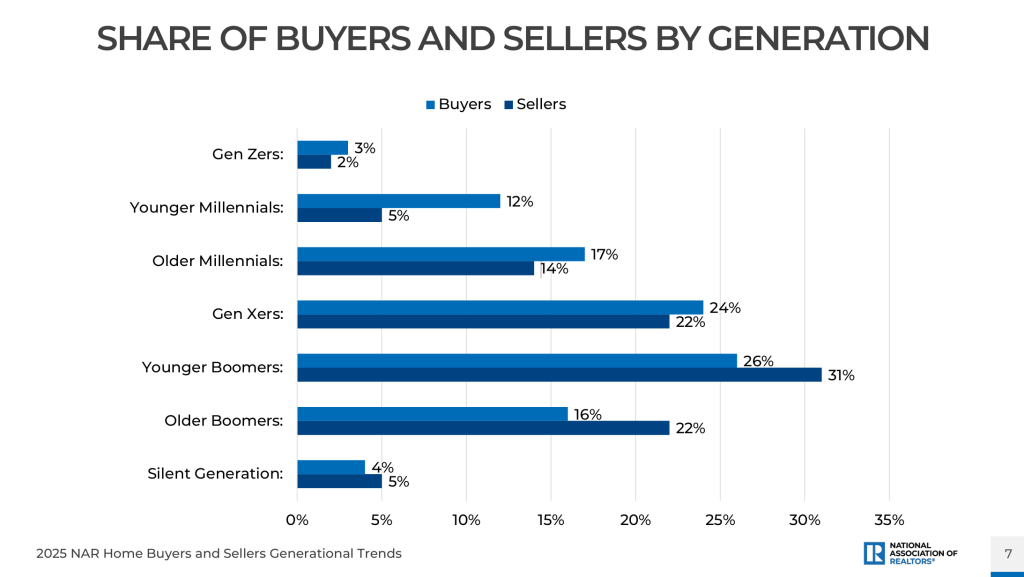

Data on generational buying behavior underscores how real this challenge is. According to the National Association of REALTORS, Gen Z (ages 18–25) composes only about 3% of recent homebuyers, and they generally enter the market with comparatively low household incomes. This indicates that while younger adults are interested in homeownership, structural affordability barriers remain substantial.

Preferences within this three-decade cohort remain split. If renting is a deliberate lifestyle choice rather than a fallback, this prioritizes mobility, shorter commitments and freedom to relocate. For others, especially those carving out space for work, content creation or future investments, ownership is a long-term play that fits ambitious goals and budgets.

If a 50-year mortgage drags equity accumulation too slowly, the trade-off may not justify ditching that [lifestyle] flexibility. Majzner, however, notes there are options.

“One, you can use a two-to-one [2-1] buy-down; that’s a concession that comes back to you that you can subsidize the monthly payment,” Majzner said. He also emphasized: “You can also choose to do a 40-year product; that in itself is going to build you equity a lot faster than a 50-year is going to.”

The proposed 50-year mortgage sits in an uncertain position. It offers immediate affordability and expanded living space prized by digital-first workers and creators, but it brings significant long-term tradeoffs – slower equity growth and higher lifetime costs.

Its viability hinges on balancing short-term flexibility vs. brand-building needs with financial stability. Ultimately, the choice reflects a broader identity question: rent for mobility or own for authenticity and stability?

Leave a comment